Experience

Partner (Member of the Firm), boutique tax law firm, Manhattan, New York (2017-2020), Attorney (2015-2016).

Tax Manager, EY, International Tax Services, Inbound Tax Group, New York, and Dallas (2011-2015); Tax Services (2010-2008).

Tax Counsel, international law firm, Vienna, Austria (2004-2007).

Tax Manager/Assistant Manager/Associate, PwC, International Tax Services and Transfer Pricing Group, Vienna, Austria (1998-2004).

Gerichtsjahr (Clerkship), Handelsgericht Wien (Commercial Court Vienna); Bezirksgericht Innere Stadt Wien (Court of First Instance for Civil Matters First District of Vienna); Landesgericht für Strafsachen Wien (Regional Court for Criminal Matters Vienna)(1997-1998).

Jurisdictions Admitted

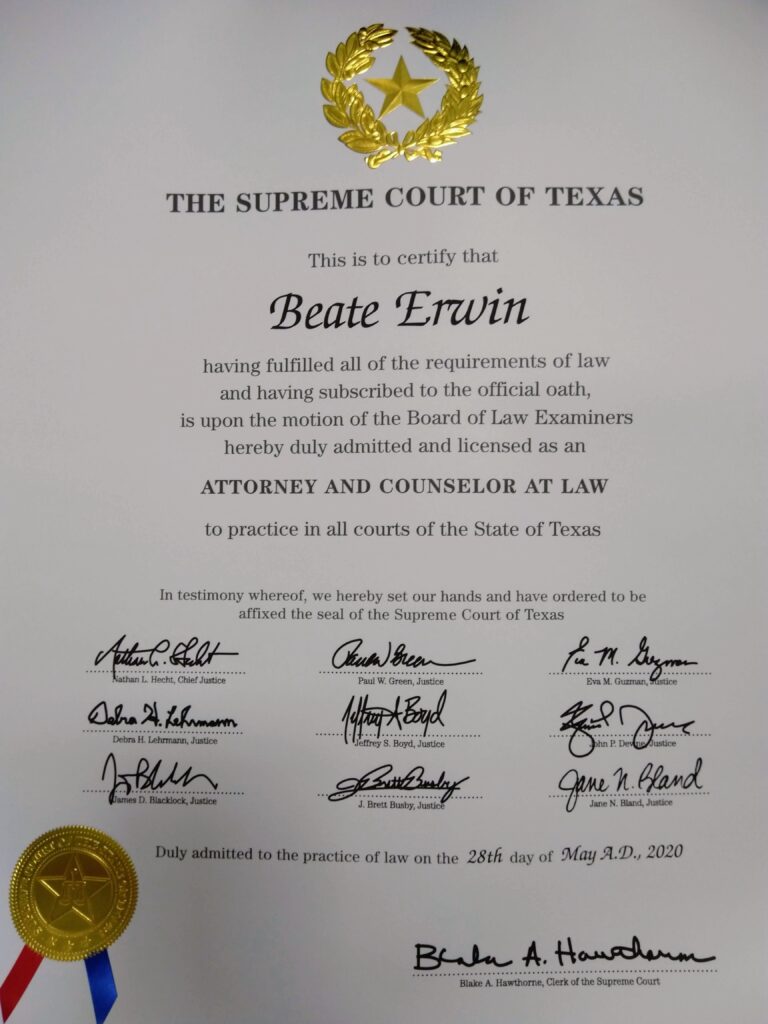

Attorney at Law: New York and Texas.

Steuerberaterin (Certified Tax Advisor): Austria.

Certifying Acceptance Agent under the Internal Revenue Service Acceptance Agent Program: United States.

Education

New York University School of Law, New York, LL.M. (Taxation)(2008).

Juridicum – Universität Wien, Vienna, Austria, Doctor iuris (cum laude); Thesis: “Societas Europaea (SE) – Cross-Border Reorganizations” (based on a book contribution published in 2006).

Juridicum – Universität Wien, Vienna, Austria, Magistra iuris (1997).

Publications

Tax Management Portfolio T.M. 6442-1st, Taxation of Foreign Entertainers and Sportsmen (Bloomberg BNA, 2019).

“A Fundamental Change of the Professional Sports Landscape Under the 2017 Tax Reform,” Global Sports Law and Tax Review (June 2018).

“Investing in America: New Hurdles for Non-US Persons Obtaining a Taxpayer Identification Number,” FYI – GGI International Tax News, No. 06 (Spring 2017).

“European Union: EC Merger Directive,” and “Austria,” Basic International Taxation vol. II, Roy Rohatgi, ed. (2nd Edition, BNA, 2007).

“New Perspectives for Austrian Holding Companies,” 47 Tax Notes International 367 (July 2007).

“Inheritance tax in Austria – the end?” CMS Tax Connect (CMS, April 2007), reproduced at European Tax Service (BNA International, April 2007).

“ECJ on Cadbury Schweppes: Austrian tax aspects,” CMS Tax Connect (CMS, November 2006), reproduced at Rivista di diritto tributario internazionale (International Tax Review Italy) no 1/2007 (January 2007).

“Austria” Chapter [co-contributor], International Expatriate Employment Handbook, A. Kontrimas and M. Samsa, eds. (Kluwer Law, 2006).

“Income Repatriation and Austria’s Capital Duty,” 42 Tax Notes International 971 (June 2006).

“Societas Europaea (SE) – Steuerliche Aspekte,” in Johannes Reich-Rohrwig, Societas Europaea – SE, ecolex spezial (Manz, 2006), p. 125-223 [listed in the catalogue of the Court of Justice of the European Union’s library, Bibliographie courante Partie B, 2134., Of/g/81, 96.255.91, C.406.9 (2006, no. 4)].

“Verbesserung der Rechte von Stiftern und Begünstigten einer Privatstiftung,” ecolex p. 536 et seq. (2005) [co-author].

“Steuerrechtliche Aspekte der Europäischen Aktiengesellschaft in Österreich,” in Janott/Frodermann, Handbuch der Europäischen Aktiengesellschaft, p. 846 et seq. (2005) [co-author].

Presentations

“Practice Management Competitive Edge – Capitalizing on Historical Lessons in an Information-Sharing World,“ panelist at Opportunities and Challenges in the Future of Global Immigration Law Practice, Global Migration Section of the American Immigration Lawyers Association / Center for International Legal Studies, Prague, Czech Republic (February 2020).

“Advising Clients Across Borders – Managing Engagements Across Areas of Expertise and Jurisdictions,“ Leading Lawyers: Building Law Firms for the Future, Center for International Legal Studies, Kitzbühel, Austria (January 2020).

“I.P. Contracts from a U.S. Tax Perspective,“ General Data Protection Regulation and Intellectual Property: An Unprecedented Pairing,” Center for International Legal Studies, Scheffau, Austria (January 27 – February 1, 2019).

“A Whirlwind of Conflicting Advice – Consolidating Client Advice from Different Practice Areas and Jurisdictions,“ panelist at Compliance in Global Immigration Practice, Global Migration Section of the American Immigration Lawyers Association / Center for International Legal Studies, Budapest, Hungary (January 2019).

“The Impact of Disruptive Technologies,“ panelist at Dentons’ Nextlaw, Rome, Italy (October, 2018).

“U.S. Tax Reform – Effects on Europe,“ International Tax Specialist Group, Spring European Conference, Vienna, Austria (April 2018).

“Ethical Issues in Corporate Immigration Compliance,“ panelist at Practice Management and Ethics in the World of Global Migration, Global Migration Section of the American Immigration Lawyers Association / Center for International Legal Studies, Salzburg, Austria (February 2018).

“Tax Issues in the Sharing Economy,“ International Bar Association Annual Conference, Sydney, Australia (October 2017) [co-moderator].

“Special Interest Session on Artists and Athletes,“ International Tax Specialist Group, World Conference, New York (November 2015).

“High net worth individuals and their investments – a US, French and UK Case Study,“ panelist at International Bar Association, Annual Conference, Vienna, Austria (October 2015).

“US Voluntary Disclosure,“ International Tax Specialist Group, Spring European Conference, Madrid, Spain (May 2015).

“BEPS Action 7,” ITS Technical Update, Webcast EY New York and Washington, D.C. (December 2014) [co-presenter].

“Permanent Establishments – Case Studies,” Korea NTS Training, EY New York (September 2014).

Professional and Community Activities

Congress of Fellows, Center for International Legal Studies.

International Bar Association: Taxes Committee and Art, Cultural Institutions, and Heritage Law Committee.

New York City Bar: Committee on Taxation of Business Entities and Sports Law Committee.

State Bar of Texas: Council Member of the Entertainment and Sports Law (TESLAW) Section and Member of the Tax Section.

Dallas Bar Association: Tax Section and Entertainment, Art & Sports Law Section.

Member, International Friends of Kunsthistorisches Museum, Vienna, Austria.

Founder, The Art of Business – New York, International Friends of Kunsthistorisches Museum:

“Insight into Counterfeiting,” The Art of Business – New York Inaugural Event,

International Friends of Kunsthistorisches Museum, Consulate General of Austria in New York, May 2019;

“Art of Business: Not Your Grandparent’s Museum,”

International Friends of Kunsthistorisches Museum, New York Historical Museum,

October 2019.

Kammer der Steuerberater und Wirtschaftsprüfer (Austrian Chamber of Certified Tax Advisors and Auditors)[currently inactive].

Languages

German (native language)

English

French (review of documents)

Spanish (basic)